Startup funding options are crucial for new businesses looking to take off in the competitive market. From bootstrapping to angel investors, venture capital, crowdfunding, and loans, this guide explores the diverse avenues available for funding startups, presented in a fresh and exciting style that resonates with high school hip vibes.

Types of Startup Funding Options

When starting a new business, one of the key challenges is securing funding to get the venture off the ground. There are various options available to entrepreneurs looking to raise capital for their startups, each with its own set of advantages and disadvantages.

Bootstrapping

Bootstrapping is a funding option where the entrepreneur uses their own personal savings or revenue generated by the business to fund its operations. This method allows the founder to maintain full control over the business and eliminates the need to give up equity to outside investors. However, bootstrapping may limit the growth potential of the business due to the lack of external funding.

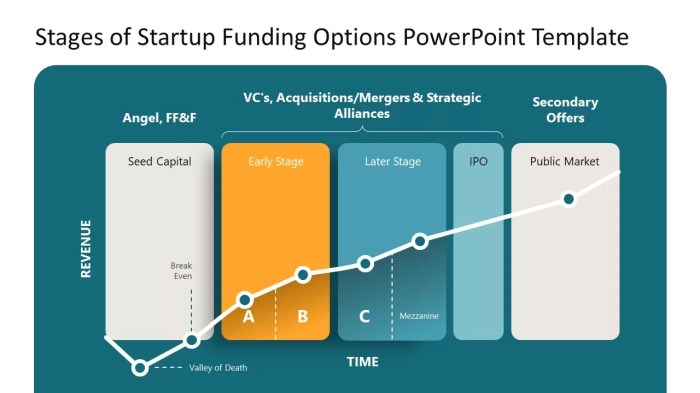

Angel Investors, Startup funding options

Angel investors are individuals who provide capital to startups in exchange for ownership equity or convertible debt. They often offer valuable advice and mentorship in addition to funding. While angel investors can provide much-needed capital and expertise, they may also demand a significant stake in the company and exert influence over key decisions.

Venture Capital

Venture capital is a form of financing provided by professional investors to high-potential startups in exchange for equity. Venture capitalists typically invest large sums of money in startups with the potential for rapid growth and high returns. While venture capital can provide access to significant capital and industry connections, it also involves giving up a portion of ownership and control over the business.

Crowdfunding

Crowdfunding involves raising small amounts of money from a large number of individuals, typically through online platforms. This method allows startups to validate their ideas, generate buzz, and raise capital from a diverse pool of investors. However, crowdfunding campaigns require significant marketing efforts and may not always result in reaching the funding goal.

Loans

Entrepreneurs can also opt to fund their startups through traditional loans from banks or financial institutions. While loans provide access to capital without giving up equity, they also come with the obligation to repay the borrowed amount with interest. Failure to repay the loan can result in financial consequences for the business owner.

Bootstrapping

Bootstrapping is a funding option for startups where the founders use their own resources to grow the business instead of seeking external investment. This could include personal savings, credit cards, or revenue generated by the business itself.

Examples of Successful Bootstrapped Startups

- Mailchimp: The popular email marketing platform was bootstrapped by its founders without any external funding. Today, it is a billion-dollar company.

- Squarespace: The website building platform was started with personal funds and has grown into a successful business without the need for outside investment.

- Basecamp: The project management tool was built by its founders without any external funding and has become a widely-used software in the industry.

Challenges and Benefits of Bootstrapping

Bootstrapping comes with its own set of challenges and benefits compared to other funding options like venture capital or angel investment.

- Challenges:

- Slow growth: Without external funding, startups may grow at a slower pace compared to those with significant investments.

- Limited resources: Bootstrapped startups have limited resources to scale quickly or explore new opportunities.

- Risk: Founders risk their own savings or assets by using them to fund the business.

- Benefits:

- Control: Founders have full control over the direction and decisions of the business without external investors influencing them.

- No debt: Bootstrapping eliminates the need to repay loans or give up equity in the company.

- Profitability: By focusing on revenue generation from the start, bootstrapped startups aim for profitability early on.

Angel Investors

Angel investors are individuals who provide financial backing for startups in exchange for ownership equity in the company. They are typically wealthy individuals who are looking to invest their own money in promising early-stage businesses. Angel investors can also offer valuable advice, mentorship, and networking opportunities to help the startup grow.

Process of Pitching to Angel Investors

When pitching to angel investors, startups need to prepare a solid business plan and pitch deck that clearly Artikels their business idea, market opportunity, competitive advantage, and financial projections. It is crucial to demonstrate a deep understanding of the market and show potential investors how their money will be used to drive growth and generate returns. Startups also need to effectively communicate their passion and commitment to the business to instill confidence in angel investors.

Benefits and Drawbacks of Working with Angel Investors

Benefits:

- Access to capital: Angel investors can provide the necessary funding to help startups get off the ground and scale their operations.

- Expertise and mentorship: Angel investors often have valuable industry knowledge and connections that can benefit the startup in terms of growth and strategic guidance.

- Speed of decision-making: Angel investors can make investment decisions quickly, allowing startups to secure funding faster than other sources.

Drawbacks:

- Lack of control: Angel investors usually require equity in the company, which means giving up some level of control and decision-making power.

- High expectations: Angel investors expect a high return on their investment, which can put pressure on startups to perform and deliver results quickly.

- Potential conflicts: Differences in vision or strategy between the startup and angel investors can lead to conflicts and challenges in decision-making.

Venture Capital

Venture capital is a form of private equity financing that investors provide to startups and small businesses that are deemed to have long-term growth potential. Venture capitalists typically take equity in the company in exchange for their investment, and they play an active role in guiding the company towards success.

Characteristics of Startups Attractive to Venture Capitalists

- High growth potential: Venture capitalists look for startups with the potential to grow rapidly and become highly profitable.

- Disruptive innovation: Startups that offer unique products or services that can disrupt the market are appealing to venture capitalists.

- Strong management team: Venture capitalists prefer startups led by experienced and capable management teams.

- Scalability: Startups that have a business model that can scale quickly and efficiently are attractive to venture capitalists.

Process of Securing Venture Capital Funding

- Develop a solid business plan: Startups need to have a detailed business plan outlining their market opportunity, growth strategy, and financial projections.

- Network with investors: Founders need to network with venture capitalists through industry events, pitch competitions, and introductions from mutual connections.

- Pitch to investors: Startups must pitch their business idea and investment opportunity to venture capitalists, highlighting the potential for high returns.

- Negotiate terms: If a venture capitalist is interested, founders need to negotiate the terms of the investment, including the amount of equity to be exchanged and the valuation of the company.

Crowdfunding

Crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and individual investors. It typically takes place on online platforms that allow startups to create campaigns to pitch their ideas and attract funds from a large number of people.

Impact of Crowdfunding on Startup Funding

Crowdfunding has revolutionized the way startups can access capital by democratizing the fundraising process. It allows entrepreneurs to reach a wider audience of potential investors, bypass traditional funding sources, and validate their business ideas based on public interest and support.

Examples of Successful Crowdfunding Campaigns

– Pebble Time smartwatch raised over $20 million on Kickstarter, making it one of the most successful crowdfunding campaigns.

– Oculus Rift, a virtual reality headset, raised $2.4 million on Kickstarter before being acquired by Facebook for $2 billion.

– Exploding Kittens, a card game, raised over $8 million on Kickstarter, breaking records for tabletop games.

Comparison of Crowdfunding Platforms

- Kickstarter: Best for creative projects, product-based startups, and artistic endeavors. All-or-nothing funding model.

- Indiegogo: Allows for both fixed and flexible funding options, suitable for a wide range of projects and startups.

- GoFundMe: Ideal for personal causes, charitable projects, and social initiatives. Keep-it-all funding model.

- Crowdcube: Geared towards equity crowdfunding for startups looking to offer shares in their company.

Loans: Startup Funding Options

When it comes to funding your startup, taking out a loan can be a viable option to get the capital you need to get your business off the ground. While loans come with risks, they also offer benefits that can help your startup grow and succeed.

Types of Loans

- Traditional Bank Loans: These are loans offered by banks and credit unions, typically with fixed interest rates and repayment terms.

- SBA Loans: Small Business Administration loans are government-backed loans that offer competitive terms and rates to startups.

- Online Lenders: Online platforms provide quick access to funding with varying interest rates and terms.

Risks and Benefits

Using loans as a funding option for your startup comes with both risks and benefits that you need to consider:

- Risks: Taking on debt can put a strain on your startup’s cash flow, especially in the early stages. If your business doesn’t perform as expected, you may struggle to repay the loan.

- Benefits: Loans can provide you with the capital you need to invest in your business and fuel growth. They can also help you build credit for your startup, making it easier to secure financing in the future.