Life insurance plans set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with an American high school hip style and brimming with originality from the outset.

When it comes to life insurance, there are various options available in the market, each with its own set of benefits and drawbacks. Understanding these options is crucial in making an informed decision that aligns with your financial goals and needs.

Types of Life Insurance Plans

Life insurance plans come in various types to cater to different needs and preferences. The main types include term life insurance, whole life insurance, and universal life insurance. Each type offers unique features and benefits, as well as drawbacks that should be considered when choosing the right plan for you.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the policyholder passes away during the term. This type of insurance is typically more affordable than whole life or universal life insurance because it does not build cash value over time. However, once the term expires, the coverage ends, and there is no investment component involved.

Whole Life Insurance, Life insurance plans

Whole life insurance provides coverage for the entire lifetime of the insured individual. It offers a death benefit to the beneficiaries and also accumulates cash value over time. The premiums for whole life insurance are usually higher than term life insurance but remain level throughout the policyholder’s life. This type of insurance provides a guaranteed death benefit and cash value that can be borrowed against or withdrawn.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that combines a death benefit with a savings component. Policyholders can adjust their premiums and death benefits within certain limits, making it more customizable than whole life insurance. The cash value in a universal life insurance policy earns interest at a rate set by the insurer and can be used to pay premiums or increase the death benefit. However, the cash value is not guaranteed, and policyholders may need to adjust their premiums to keep the policy in force.

Factors to Consider When Choosing a Life Insurance Plan

When selecting a life insurance plan, there are several key factors that individuals should consider to ensure they choose the right coverage for their needs.

Age

Age plays a crucial role in determining the type of life insurance plan that is most suitable. Younger individuals may opt for a term life insurance plan, which offers coverage for a specific period at a lower cost. On the other hand, older individuals may consider permanent life insurance options for lifelong coverage.

Health

Health is another important factor to consider when choosing a life insurance plan. Individuals with pre-existing medical conditions may find it challenging to get affordable coverage. It’s essential to disclose all health-related information accurately to avoid any issues with claims in the future.

Financial Goals

Understanding your financial goals is crucial in selecting the right life insurance plan. Whether you want to provide financial security for your family, pay off debts, or leave an inheritance, your coverage amount should align with your financial objectives.

Dependents

The number of dependents you have will impact the type and amount of life insurance coverage you need. If you have young children or family members who rely on your income, you may need a higher coverage amount to secure their financial future.

Coverage Amount, Premiums, and Policy Terms

The coverage amount, premiums, and policy terms are significant factors to consider when choosing a life insurance plan. The coverage amount should be sufficient to meet your financial obligations and provide for your loved ones. Premiums should be affordable and fit within your budget. Additionally, understanding the policy terms, such as the length of coverage and any exclusions, is essential for making an informed decision.

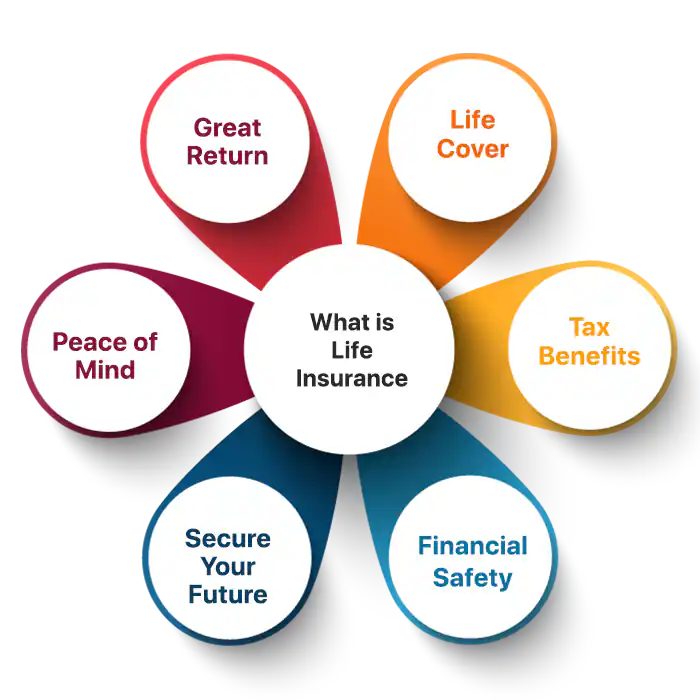

Importance of Life Insurance

Life insurance is a crucial financial tool that provides protection and peace of mind for you and your loved ones. It ensures that in the event of your death, your beneficiaries are financially supported and can maintain their quality of life.

Financial Security

Life insurance plays a vital role in providing financial security for your family. In case of your untimely demise, the death benefit from the policy can help cover expenses such as mortgage payments, education costs, and daily living expenses. This ensures that your loved ones are not burdened with financial hardships during an already difficult time.

Peace of Mind

Knowing that you have a life insurance plan in place can provide you with peace of mind. It allows you to rest assured that your family will be taken care of financially, even if you are no longer there to provide for them. This security can help alleviate anxiety and stress, allowing you to focus on living your life to the fullest.

Real-life Scenario

Imagine a scenario where the breadwinner of a family suddenly passes away without any life insurance coverage. The surviving family members are left struggling to make ends meet, facing the risk of losing their home and not being able to afford basic necessities. On the other hand, a family with a life insurance policy in place can continue their lives with financial stability, knowing that they are protected.

Protection for Loved Ones

Life insurance plans act as a safety net for your loved ones, ensuring that they are taken care of even after you are gone. The death benefit can help cover funeral expenses, outstanding debts, and provide income replacement for your family members. This protection allows your loved ones to grieve without the added stress of financial insecurity.

How to Calculate Life Insurance Coverage Needs

When determining the appropriate amount of life insurance coverage you need, it’s crucial to consider various factors to ensure financial security for your loved ones in case of any unforeseen circumstances.

Factors to Consider

- Income Replacement: Calculate how much your family would need to maintain their lifestyle in case of your absence. Consider factors like current income, future earnings, and inflation.

- Debts: Take into account any outstanding debts such as mortgages, loans, or credit card balances that would need to be paid off.

- Future Expenses: Factor in future expenses like children’s education, healthcare costs, and other financial obligations.

- Inflation: Consider the impact of inflation on the purchasing power of your life insurance coverage over time.

One common formula to calculate life insurance coverage needs is:

Coverage Amount = (Income Replacement + Debts + Future Expenses) / (1 – Inflation Rate)