Diving into the realm of insurance claims process, this piece invites readers on a journey filled with insights and clarity, promising an engaging exploration of this essential procedure.

From understanding the basics to navigating the complexities, this guide will equip you with the knowledge needed to breeze through the insurance claims process effortlessly.

Overview of Insurance Claims Process

Insurance claims process refers to the procedure followed by individuals or businesses to request financial compensation from their insurance provider for a covered loss or damage. This process is crucial in ensuring that policyholders receive the financial assistance they need to recover from unexpected events.

Importance of a Smooth Insurance Claims Process

A smooth insurance claims process is essential for policyholders as it provides them with timely financial support during difficult times. It helps in reducing stress and anxiety by ensuring that claims are processed efficiently and accurately. Additionally, a smooth claims process enhances the trust and credibility of the insurance company in the eyes of its customers.

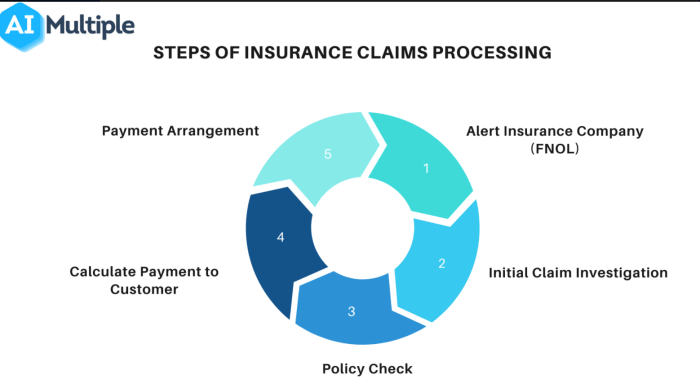

Key Stages Involved in an Insurance Claims Process

- Reporting the Claim: The first step in the claims process is to report the loss or damage to the insurance company. This can usually be done online, over the phone, or through a mobile app.

- Evaluation: Once the claim is reported, the insurance company will assess the extent of the loss or damage to determine if it is covered under the policy.

- Documentation: Policyholders are required to provide documentation to support their claim, such as photos, repair estimates, and police reports.

- Settlement: After the evaluation and documentation review, the insurance company will offer a settlement amount to the policyholder. This amount is based on the terms of the policy and the extent of the loss.

- Resolution: Once the settlement amount is accepted, the insurance company will process the payment to the policyholder to cover the loss or damage.

Types of Insurance Claims

Insurance claims come in various types depending on the nature of the loss or damage. Here are some of the most common types of insurance claims along with the documentation required and processing times for each:

Health Insurance Claims

Health insurance claims are related to medical expenses incurred by the insured individual. The documentation required for health insurance claims typically includes medical bills, prescriptions, and doctor’s reports. Processing times for health insurance claims can vary depending on the complexity of the case and the insurance provider.

Auto Insurance Claims, Insurance claims process

Auto insurance claims are filed for damages or losses related to vehicles. The documentation required for auto insurance claims may include a police report, photos of the damage, repair estimates, and the insured individual’s driver’s license. Processing times for auto insurance claims can range from a few days to several weeks, depending on the extent of the damage and the insurance company.

Property Insurance Claims

Property insurance claims are filed for damage or loss to property, such as homes or belongings. The documentation required for property insurance claims may include photos of the damage, receipts for damaged items, and a list of inventory. Processing times for property insurance claims can vary depending on the extent of the damage and the insurance provider.

Initiating an Insurance Claim: Insurance Claims Process

When it comes to initiating an insurance claim, there are specific steps that policyholders need to follow to ensure a smooth process. Reporting a claim to your insurance provider promptly is crucial to getting the assistance you need. Here are some tips on how to start the claims process and what information to gather:

Contact Your Insurance Provider

- As soon as an incident occurs that may lead to a claim, contact your insurance provider. This can typically be done by phone, online, or through a mobile app.

- Provide all necessary details about the incident, including the date, time, and location.

- Be prepared to provide your policy number and personal information to verify your identity.

Gather Important Information

- Collect any documentation related to the incident, such as photos, videos, or witness statements.

- Keep track of any expenses incurred as a result of the incident, including receipts for repairs or medical bills.

- Make a detailed list of the items that were damaged or lost, along with their estimated value.

Documentation and Information Required

When filing an insurance claim, having the right documentation and providing accurate information is crucial. This ensures a smooth and efficient claims process, helping policyholders receive the compensation they are entitled to.

Essential Documents for Filing an Insurance Claim

- Insurance policy details

- Claim form provided by the insurance company

- Evidence of the incident (photos, videos, etc.)

- Police report (if applicable)

- Medical records (for health insurance claims)

Importance of Providing Accurate Information

Accurate information is essential during the claims process as it helps prevent delays or denials. Providing false or misleading information can lead to claim rejection or reduced compensation. It is important to be honest and transparent when providing details related to the incident.

Ensuring Availability of Necessary Documentation

To ensure you have all necessary documentation in order, it is recommended to keep a file with all relevant paperwork organized and easily accessible. This includes insurance policies, receipts, invoices, and any other documents related to the claim. Being prepared with the required information can expedite the claims process and increase the chances of a successful claim outcome.

Evaluation and Investigation Process

When it comes to evaluating and investigating insurance claims, insurance companies follow a specific process to determine the validity of the claim and the extent of coverage. This involves a thorough assessment of the damage or loss, as well as the circumstances surrounding the claim.

Role of Adjusters

Adjusters play a key role in the evaluation and investigation process. These professionals are responsible for assessing the damage, gathering relevant information, and determining the coverage provided by the policy. They work closely with the policyholder to ensure a fair and accurate resolution to the claim.

- Adjusters conduct on-site inspections to assess the extent of the damage and gather evidence to support the claim.

- They review the policy terms and conditions to determine the coverage available for the specific type of loss.

- Adjusters may also interview witnesses, review police reports, and consult with experts to validate the claim.

- Ultimately, adjusters play a crucial role in helping insurance companies make informed decisions regarding the settlement of the claim.

Factors Impacting Evaluation

Various factors can impact the evaluation of an insurance claim, influencing the final decision made by the insurance company. These factors include:

- The extent of the damage or loss: The severity of the damage will directly affect the amount of compensation provided.

- Evidence supporting the claim: The availability of evidence, such as photos, receipts, and witness statements, can strengthen the validity of the claim.

- Policy coverage limits: The specific terms and conditions Artikeld in the policy will dictate the extent of coverage available for the claim.

- Previous claim history: A policyholder’s past claims history can impact the evaluation of a new claim, potentially affecting the outcome.