Diving into startup funding options, this intro sets the stage for a deep dive into the world of funding with a fresh, engaging twist that resonates with high school coolness.

Get ready to uncover the secrets behind bootstrapping, angel investors, and venture capital, and how they can make or break a startup’s journey to success.

Overview of Startup Funding Options

In the world of startups, exploring various funding options is crucial for success. Securing the right funding can make or break a new business, allowing it to grow and thrive in a competitive market. Let’s delve into the different types of funding sources available to startups and their pros and cons.

Bootstrapping

Bootstrapping is the process of funding a startup using personal savings or revenue generated by the business itself. While this allows the founders to maintain full control and ownership, it can limit the growth potential due to a lack of external resources.

Angel Investors

Angel investors are individuals who provide capital to startups in exchange for ownership equity or convertible debt. They often offer valuable expertise and connections in addition to funding, but may have high expectations for returns on their investment.

Venture Capital, Startup funding options

Venture capital firms invest in startups with high growth potential in exchange for equity. This type of funding can provide substantial capital for rapid expansion, but it also involves giving up a portion of ownership and control to investors.

Examples of Successful Startups

– Bootstrapping: Mailchimp, a marketing automation platform, started with a small loan and grew without external funding.

– Angel Investors: Uber, the ride-sharing giant, received early investments from angel investors like Chris Sacca.

– Venture Capital: Airbnb, the accommodation rental platform, secured funding from venture capital firms like Sequoia Capital.

Bootstrapping: Startup Funding Options

Bootstrapping is a funding option where startups rely on their own resources to grow and develop their business, rather than seeking external funding from investors or loans. This means that founders use personal savings, revenue generated from the business, or other creative means to fund their operations.

Advantages of Bootstrapping

- Independence: By bootstrapping, founders can maintain complete control over their business without having to answer to outside investors.

- Financial Discipline: Bootstrapping forces startups to be more financially responsible and prioritize spending only on essential needs.

- Faster Decision Making: Without external stakeholders to consult, decisions can be made quickly, allowing for more agile operations.

Disadvantages of Bootstrapping

- Limited Resources: Bootstrapping may limit the growth potential of a startup, as there are only a finite amount of personal funds available.

- Risk: If the business fails, founders risk losing not only their business but also their personal savings invested in the venture.

- Slower Growth: Without external funding, startups may experience slower growth compared to those who have access to larger amounts of capital.

Tips for Bootstrapping Startups

- Focus on Profitability: Prioritize generating revenue early on to sustain the business and fund future growth.

- Minimize Costs: Keep expenses low and avoid unnecessary spending to maximize the use of limited resources.

- Be Resourceful: Look for creative ways to fund operations, such as bartering services, using open-source software, or leveraging partnerships.

Real-Life Examples of Bootstrapped Startups

- Basecamp: The project management software company was bootstrapped by its founders, Jason Fried and David Heinemeier Hansson, and grew to become a successful and profitable business.

- Mailchimp: The email marketing platform started as a side project of its co-founders Ben Chestnut and Dan Kurzius and was bootstrapped until it reached significant revenue and user base.

Angel Investors

Angel investors play a crucial role in funding startups by providing capital in exchange for ownership equity or convertible debt.

Role of Angel Investors

Angel investors typically look for potential investment opportunities in early-stage startups with high growth potential. They often provide not only financial support but also valuable mentorship, guidance, and industry connections to help the startup succeed.

What Angel Investors Look For

- Strong and innovative business idea with a clear market need

- Skilled and dedicated founding team with relevant experience

- Significant growth potential and scalability of the startup

- Solid business plan and realistic financial projections

Benefits of Angel Investment

- Flexible terms compared to traditional funding sources like banks or venture capital firms

- Hands-on support and mentorship from experienced investors

- Potential access to valuable networks and resources

- Early validation of the business idea and potential for follow-on funding

Tips to Attract Angel Investors

- Focus on building a strong and compelling pitch deck that highlights the unique value proposition of your startup

- Network actively to connect with potential angel investors through events, conferences, and online platforms

- Showcase traction and progress achieved by the startup to demonstrate market validation and growth potential

- Be transparent and open to feedback, and be prepared to negotiate terms that align with the interests of both parties

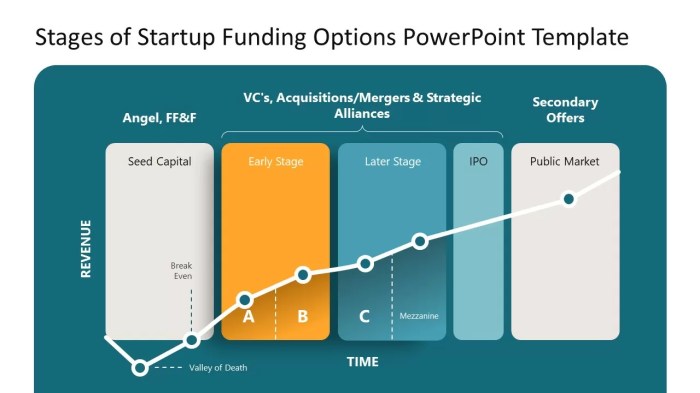

Venture Capital

Venture capital plays a crucial role in the startup ecosystem by providing funding to high-potential, early-stage companies in exchange for equity. This form of financing helps startups scale up quickly and reach their growth targets.

Securing Venture Capital Funding

Securing venture capital funding typically involves a multi-step process. Startups first need to identify potential venture capital firms that align with their industry and stage of growth. Once identified, entrepreneurs pitch their business idea to these firms, highlighting the market opportunity, the solution their product or service provides, and the potential for growth and return on investment. If the venture capitalists see potential in the startup, they will conduct due diligence to assess the business further before making an investment offer.

Criteria for Evaluating Investment Opportunities

Venture capitalists evaluate investment opportunities based on a set of criteria that may include the market size and potential, the strength of the founding team, the uniqueness of the product or service, the competitive landscape, and the scalability of the business model. They look for startups with high growth potential and a clear path to profitability.

Examples of Startups with Venture Capital Funding

– Uber: Uber, the ride-sharing giant, received significant venture capital funding in its early days to fuel its expansion globally.

– Airbnb: Airbnb, the popular online marketplace for lodging and tourism experiences, also raised venture capital to support its growth and innovation.

– SpaceX: SpaceX, the aerospace manufacturer and space transportation company, secured venture capital funding to develop its cutting-edge technology and launch missions into space.