Yo, diving into the world of travel insurance benefits! Get ready to uncover the perks that keep your trips smooth and worry-free. From medical coverage to baggage protection, we got you covered.

Let’s break it down and see why having travel insurance is a game-changer for your next adventure.

Introduction to Travel Insurance Benefits

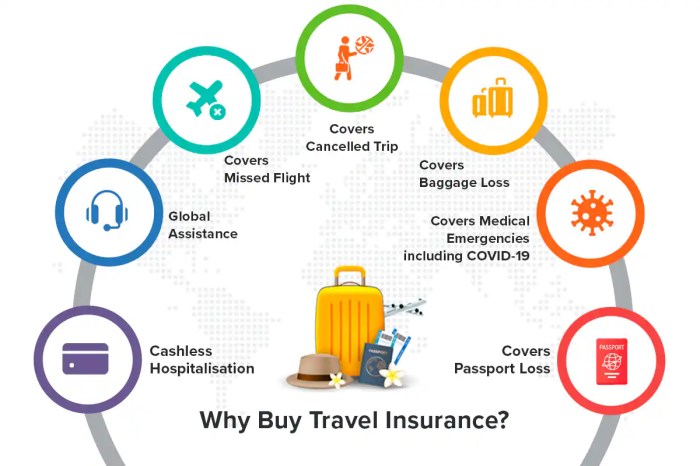

Travel insurance is a type of coverage that helps protect travelers from unexpected events that may occur before or during their trip. It provides financial protection against trip cancellations, medical emergencies, lost luggage, and other unforeseen circumstances. Considering travel insurance before a trip is essential to mitigate risks and ensure peace of mind while traveling.

Benefits of Travel Insurance

- Trip Cancellation Coverage: Reimburses you for prepaid, non-refundable trip expenses if you have to cancel your trip due to a covered reason.

- Emergency Medical Coverage: Covers medical expenses incurred due to illness or injury while traveling.

- Baggage Loss Protection: Provides compensation for lost, stolen, or damaged luggage during your trip.

- Travel Assistance Services: Offers 24/7 support for emergencies such as medical referrals, legal assistance, and travel arrangements.

Types of Travel Insurance Benefits

When it comes to travel insurance, there are various types of benefits that can provide coverage and protection during your trip. It’s important to understand the different options available to ensure you have the right coverage for your needs.

Medical Coverage

Medical coverage is one of the most important benefits of travel insurance. It can help cover medical expenses if you get sick or injured while traveling. This can include hospital stays, doctor visits, medications, and emergency medical evacuation.

Trip Cancellation

Trip cancellation coverage can reimburse you for prepaid, non-refundable expenses if you have to cancel your trip for a covered reason, such as illness, injury, or severe weather. This benefit can help protect your investment in case unexpected circumstances force you to change your plans.

Baggage Loss, Travel insurance benefits

Baggage loss coverage can provide reimbursement if your luggage is lost, stolen, or damaged during your trip. This can help cover the cost of replacing essential items like clothing, toiletries, and personal belongings.

Basic vs. Comprehensive Travel Insurance Plans

When choosing a travel insurance plan, you’ll typically have the option of selecting either a basic or comprehensive policy. Here’s a comparison of the benefits offered by each:

Basic Travel Insurance

– Provides essential coverage for medical emergencies, trip cancellations, and baggage loss.

– Typically more affordable but may have lower coverage limits and fewer benefits.

– Best for travelers with minimal pre-paid expenses and shorter trips.

Comprehensive Travel Insurance

– Offers a wider range of benefits, including coverage for trip interruptions, travel delays, and emergency assistance services.

– Higher coverage limits and more comprehensive protection for a variety of travel-related issues.

– Ideal for travelers with expensive pre-paid expenses, longer trips, or those looking for more extensive coverage.

Reading the Fine Print: Travel Insurance Benefits

It’s crucial to read the fine print of your travel insurance policy to fully understand the extent of coverage and any exclusions or limitations. Pay attention to details such as coverage limits, exclusions for pre-existing conditions, and requirements for filing claims. Being informed about your policy can help you make the most of your coverage and avoid any surprises during your trip.

Medical Benefits of Travel Insurance

Travel insurance provides essential medical coverage for travelers, ensuring they receive proper care and assistance in case of unexpected health issues while abroad.

Coverage Details

- Emergency medical treatment for illnesses or injuries

- Medical evacuation to the nearest adequate medical facility

- Repatriation of remains in case of death

- 24/7 assistance for medical emergencies

Examples of Crucial Situations

- Breaking a bone while hiking in a remote area

- Contracting a serious illness requiring hospitalization

- Needing emergency surgery after an accident

Process for Making a Medical Claim

- Inform the insurance provider immediately

- Provide all necessary documentation, including medical reports and receipts

- Follow the instructions given by the insurance company for claim submission

- Stay in touch with the insurance provider throughout the process for updates

Trip Cancellation and Interruption Benefits

Travel insurance often includes trip cancellation and interruption benefits to protect travelers from financial losses due to unexpected events. Trip cancellation coverage reimburses you for pre-paid, non-refundable expenses if you have to cancel your trip before departure. On the other hand, trip interruption coverage helps cover the costs if you have to cut your trip short and return home unexpectedly.

How Trip Cancellation and Interruption Benefits Work

Trip cancellation benefits typically cover reasons such as illness, injury, or death of the traveler, a family member, or a traveling companion, natural disasters, terrorist attacks, or airline strikes. To claim these benefits, you will need to provide documentation such as medical certificates, death certificates, or official statements from airlines or travel providers. It’s essential to review your policy to understand the specific covered reasons and documentation requirements.

Examples of Scenarios

- Your elderly parent falls ill a week before your trip, and you have to cancel your vacation to take care of them.

- Your connecting flight gets canceled due to severe weather, causing you to miss your cruise departure. Trip interruption benefits can help cover the cost of catching up with the cruise at the next port.

Documentation for Claiming Benefits

- Medical certificates or reports from a licensed healthcare provider for illness or injury claims.

- Death certificates in case of the passing of a family member or traveling companion.

- Official statements from airlines or travel providers confirming cancellations or delays for covered reasons.

Baggage Loss and Delay Benefits

When it comes to baggage loss and delay benefits in travel insurance, it’s essential to understand the coverage provided and how you can make the most of it during your travels.

Baggage Loss Coverage

- Travel insurance typically covers the cost of replacing lost baggage up to a certain limit.

- Make sure to file a report with the airline or transportation provider immediately if your baggage goes missing.

- Keep all receipts for your belongings to help with the claims process.

Baggage Delay Coverage

- If your baggage is delayed, travel insurance can reimburse you for essential items like clothing and toiletries.

- Check your policy for the specific time frame required for baggage delay compensation to kick in.

- Save your receipts for any purchases made due to the delay, as you will need them for reimbursement.

Claiming Compensation for Lost or Delayed Baggage

- Notify your insurance provider as soon as you realize your baggage is lost or delayed.

- Fill out the necessary forms and provide all requested documentation, such as proof of ownership and receipts.

- Work closely with the insurance company to ensure a smooth claims process and timely reimbursement.